The rapid global adoption of Bitcoin has fundamentally changed how people think about money, ownership, and financial access. While centralized cryptocurrency exchanges initially dominated the market, a growing number of users now prefer peer-to-peer (P2P) Bitcoin exchanges that allow them to trade directly with one another. This shift is driven by increasing concerns around custodial risk, regulatory uncertainty, privacy, and accessibility especially in regions underserved by traditional financial systems.

Starting a peer-to-peer Bitcoin exchange business today is no longer a fringe idea. It is a viable, scalable business opportunity that aligns closely with Bitcoin’s original philosophy of decentralization and trust minimization. However, launching such a platform requires far more than a basic marketplace. It demands a deep understanding of market dynamics, regulatory environments, security architecture, and user trust mechanisms.

This guide explores how to start a P2P Bitcoin exchange business from the ground up, covering strategic decisions, technical foundations, operational considerations, and growth pathways—while highlighting the role of modern P2P exchange software and professional development services.

Understanding the P2P Bitcoin Exchange Business Model

At its core, a peer-to-peer Bitcoin exchange connects buyers and sellers directly, without acting as a custodian of user funds. Unlike centralized exchanges that pool liquidity and control user assets, a P2P exchange acts as an intermediary facilitator. It provides the infrastructure such as escrow, dispute resolution, and user reputation systems while allowing participants to retain control over their Bitcoin.

This model shifts trust away from a single institution and distributes it across transparent rules and mechanisms. For entrepreneurs, this means lower custodial risk but higher responsibility in designing systems that prevent fraud and disputes. The business generates revenue primarily through transaction fees, premium services, or value-added features rather than market-making or proprietary trading.

Understanding this distinction is critical before investing in any P2P Exchange platform, as it influences compliance requirements, technical design, and long-term scalability.

Market Research and Business Positioning

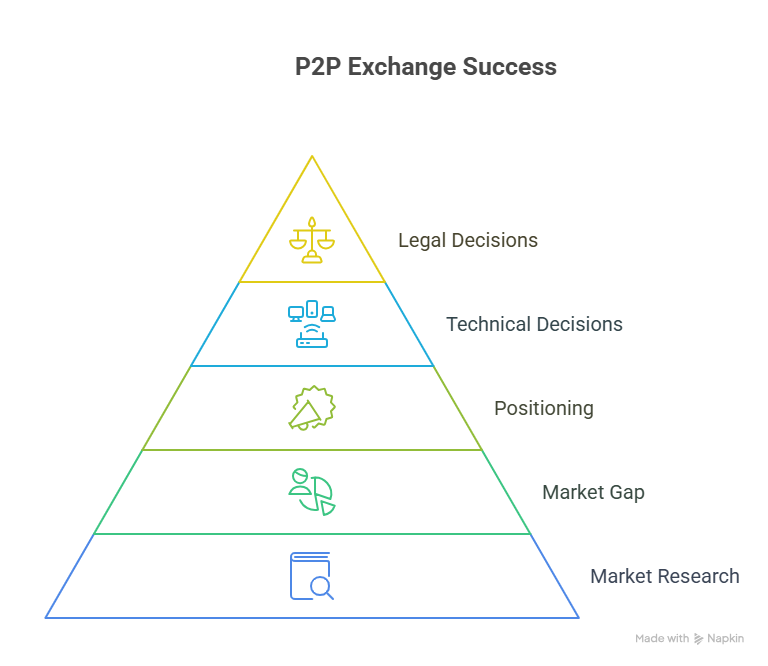

Before writing code or selecting technology partners, founders must conduct thorough market research. P2P exchanges are highly sensitive to local conditions. Payment methods, regulatory expectations, and user behavior vary significantly across regions.

Successful platforms typically identify a clear market gap such as underserved local currencies, specific payment rails, or regions with restrictive banking systems. For example, P2P exchanges gained massive traction in parts of Africa and Latin America precisely because centralized fiat on-ramps were limited or unreliable.

Positioning also matters. Some platforms emphasize privacy and decentralization, aligning with a P2P decentralized exchange philosophy. Others adopt hybrid models that balance compliance and usability. Defining this positioning early helps guide technical and legal decisions later.

Legal and Regulatory Considerations

One of the most underestimated aspects of starting a P2P Bitcoin exchange business is regulation. While P2P platforms often avoid holding user funds, they are still subject to financial regulations in many jurisdictions.

Depending on your target market, you may need to address:

Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements

Licensing or registration as a virtual asset service provider

Data protection and consumer protection laws

The regulatory landscape in 2025–2026 is more defined than in earlier years, but also more fragmented. Some regions encourage innovation with clear frameworks, while others impose strict controls. Consulting legal experts early and aligning your platform architecture accordingly is essential for long-term viability.

Choosing the Right Technology Approach

The technical foundation of your exchange will largely determine its success or failure. At this stage, founders face a major decision: build the platform from scratch or leverage existing p2p exchange development services.

Building a platform internally offers maximum customization and ownership but requires significant time, capital, and expertise across blockchain engineering, backend development, security, and payments. This approach is typically viable only for teams with strong in-house technical capabilities and long-term strategic goals.

Most entrepreneurs choose to work with a specialized p2p exchange development company that provides ready-made or white-label p2p cryptocurrency exchange software. These solutions significantly reduce time-to-market while offering proven architectures, security features, and scalability.

Core Features of a P2P Bitcoin Exchange Platform

Regardless of whether you build or buy, certain features are non-negotiable for a successful platform.

Escrow Mechanism

Escrow is the backbone of trust in P2P trading. When a buyer initiates a trade, the seller’s Bitcoin is locked in escrow until payment is confirmed. This prevents fraud and ensures fairness. Modern p2p exchange software supports automated escrow workflows that minimize manual intervention.

User Reputation and Rating System

Trust between strangers is built over time. A transparent reputation system allows users to evaluate counterparties based on past behavior. High-quality platforms track completed trades, disputes, and feedback to create reliable trust signals.

Payment Method Integration

Supporting local payment methods is one of the strongest differentiators of a P2P exchange. Bank transfers, mobile wallets, and region-specific payment apps must be integrated securely and efficiently.

Dispute Resolution and Support

Even with escrow, disputes will occur. A structured dispute resolution system—supported by transaction logs, chat records, and clear rules—is essential to maintain user confidence and platform integrity.

Security Architecture and Risk Management

Security is not optional in a financial platform it is existential. P2P exchanges face unique risks, including payment fraud, social engineering attacks, and platform abuse.

Robust security architecture includes multi-factor authentication, anti-phishing measures, encrypted communications, and continuous monitoring. Regular audits of escrow logic and wallet integrations are also critical.

Established p2p exchange development services often include these safeguards by default, leveraging real-world experience to anticipate attack vectors that new teams may overlook.

Monetization Strategies for P2P Bitcoin Exchanges

A sustainable business model is essential. Most P2P Bitcoin exchanges monetize through transaction fees charged to buyers, sellers, or both. Fee structures must balance profitability with competitiveness, as users are highly price-sensitive.

Additional revenue streams may include premium listings, subscription plans for high-volume traders, API access, or escrow-based value-added services. The key is transparency—hidden fees erode trust quickly in P2P environments.

Building Liquidity and User Trust

Liquidity is the lifeblood of any exchange. Early-stage platforms often struggle with the "chicken and egg" problem: users won’t join without liquidity, and liquidity won’t form without users.

Successful platforms often seed liquidity by onboarding trusted traders, offering incentives for early adopters, or partnering with local communities. Marketing efforts should emphasize safety, ease of use, and local relevance rather than abstract technical features.

Trust is equally important. Clear policies, responsive support, and consistent enforcement of rules help establish credibility in the early stages.

Scaling the Business

Once the platform gains traction, scaling introduces new challenges. Higher trade volumes require more robust infrastructure, improved monitoring tools, and expanded customer support.

Many platforms expand geographically, adding support for new currencies and payment methods. This must be done carefully, with attention to local regulations and user behavior.

Working with an experienced p2p exchange development company can simplify scaling, as many solutions are designed to support modular expansion.

Case Study Insight: Why P2P Platforms Thrive in Emerging Markets

In regions with volatile currencies or limited banking access, P2P Bitcoin exchanges often outperform centralized platforms. Users value the ability to transact directly using local methods and to preserve value in Bitcoin during economic uncertainty.

Platforms that succeed in these markets typically focus on simplicity, trust, and community engagement rather than advanced trading features. This underscores the importance of aligning your platform’s design with real user needs rather than assumptions.

Best Practices for Long-Term Success

The Best Peer to Peer Exchange Development strategies prioritize adaptability. Regulations will change, user expectations will evolve, and competition will intensify. Platforms that succeed are those that continuously improve their technology, governance, and user experience.

Investing in analytics, feedback loops, and ongoing security improvements is essential. Equally important is maintaining open communication with users and responding transparently to issues.

Conclusion

Starting a peer-to-peer Bitcoin exchange business is both an opportunity and a responsibility. While the P2P model offers resilience, flexibility, and alignment with decentralization principles, it also demands careful planning, strong technology, and disciplined execution.

By understanding the market, choosing the right P2P exchange software, and partnering with reliable p2p exchange development services, entrepreneurs can build platforms that are secure, scalable, and trusted. As Bitcoin adoption continues to grow, P2P exchanges will remain a vital bridge between local economies and the global crypto ecosystem.

For founders willing to invest in the right foundations, a P2P Bitcoin exchange is not just a product, it is a long-term infrastructure business with global relevance.

Write a comment ...